|

|

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

|||

|

|

|||

|

|

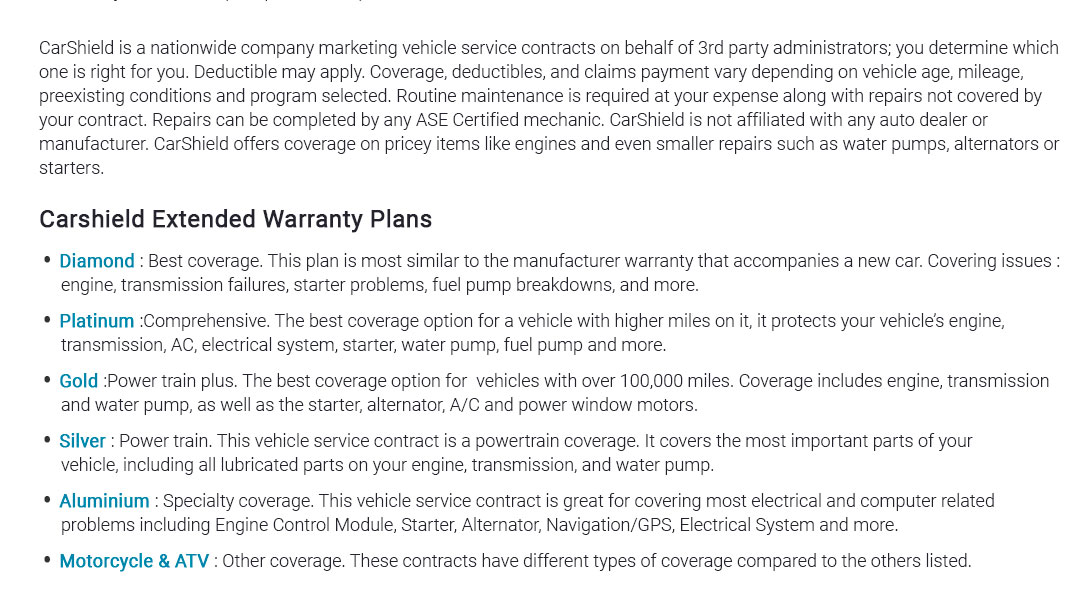

Understanding the Costs of Car Repair InsuranceCar repair insurance, often referred to as mechanical breakdown insurance, is an intriguing subject that piques the curiosity of many car owners. As vehicles become more technologically advanced, the complexity-and consequently, the cost-of repairs rises. This has led to a surge in interest regarding car repair insurance as a potential buffer against unexpected expenses. But what exactly does this insurance entail, and how much should one expect to pay? First, it's essential to clarify what car repair insurance covers. Unlike standard auto insurance that kicks in following accidents, this type of policy typically covers the cost of repairing mechanical failures after the warranty expires. It's akin to an extended warranty but often more flexible and tailored to your vehicle's specific needs. Yet, as with any insurance, the devil is in the details. The cost of car repair insurance can vary significantly, influenced by several factors. These include the make and model of your vehicle, its age and mileage, and even your driving habits. For instance, a luxury car owner may find themselves facing higher premiums due to the expensive nature of parts and labor for such vehicles. Similarly, a high-mileage car might attract higher costs due to the increased likelihood of breakdowns. On average, you might expect to pay anywhere from $300 to $600 annually for this type of coverage, although this can fluctuate based on the aforementioned factors. While this might seem like a considerable outlay, it could potentially save you thousands in the event of a major mechanical failure. Consider the cost of replacing a transmission or a complex electrical system, and suddenly, the insurance premium appears more palatable. It's also wise to ponder the deductible aspect of these policies. Deductibles can range from $100 to $500 or more, affecting both the monthly premium and your out-of-pocket expenses when repairs are needed. It's a delicate balance between choosing a higher deductible for lower premiums or a lower deductible to minimize immediate expenses when making a claim.

In conclusion, while the cost of car repair insurance might give some pause, it can be a valuable investment for those looking to shield themselves from the financial shock of unexpected vehicle repairs. It's a decision that requires careful consideration, weighing the costs against the potential benefits, and taking into account your vehicle's specific needs. For those who prefer certainty over unpredictability, this insurance offers a compelling safety net. Ultimately, each car owner's decision will hinge on their unique circumstances and their appetite for risk versus security. https://www.thriveinsurance.com/business-insurance/specialized-business-insurance/oklahoma-auto-repair-insurance

This guide explores everything you need to know about auto repair insurance in Oklahoma, from understanding the basics to selecting the best policy for your ... https://howmuch.net/costs/auto-repair-shop-insurance-cost

The range of prices for a $1 to $2 million limit policy is $39 to $89 per month, but those costs can be higher with more extensive coverage. https://www.nextinsurance.com/business/auto-repair-shop-insurance/

How much does auto mechanic repair insurance cost? You can save up to 19% when you buy auto mechanic shop insurance with NEXT. The exact amount you pay will ...

|